WHY CHOOSE US

It's All About Relationships, Experience, And Trust

You’ve worked too hard all these years to leave the handling of your retirement funds with just anyone. It must be someone with the right experience, who understands both your goals and your fears, and has the financial knowledge how to protect it while investing for growth. They also must always have your best interests in mind.

In other words, someone you can trust.

We at O’Neil Financial have 65 years of combined experience helping hundreds of clients do just that. Our main focus is building strong, service based relationships. We personally get to know you first, then focus our efforts into designing sound, financial plans that are custom tailored to fit your unique and individual needs. Delivering “integrity based” financial planning solutions is our #1 priority.

In addition, we don’t just offer information that could potentially help you financially, we strive to educate you in all areas of life.

We don’t just care about your finances, we care about you.

Performance Driven

Anyone can manage your funds, but do they maximize your results?

65 Years of Combined Experience

That is the total combined number of years Bill and Mark have been working in this industry

100% Commitment

Our first priority is, and will always be, your best interests - we are Fiduciaries.

Relentless Pursuit to Better Serve You

Whether it's the newest technology or latest fund type, we've got your back.

300+ Satisfied Clients

Success is only measured by client satisfaction

300+ Lifelong Friendships

When we enter into a new client relationship it's for the long hall, and all our decisions reflect that.

We don’t just care about your finances, we care about you.

How do we accomplish this???

PERSONALIZED COMPREHENSIVE ADVICE

No cookie-cutter solutions here. We are dedicated to get to know you to best serve your needs.

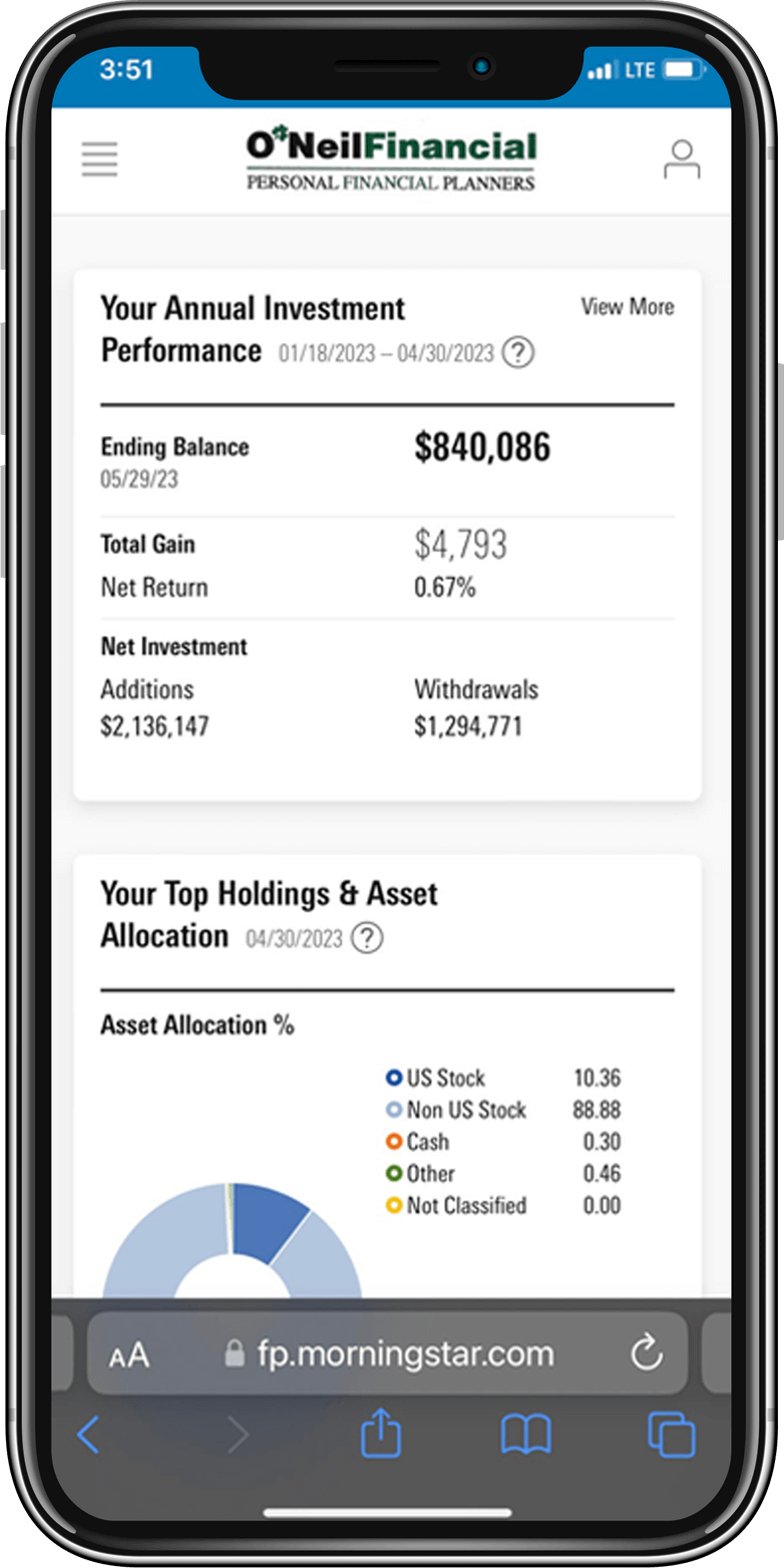

ONLINE GOAL TRACKING

No need to always pay a personal visit, unless you prefer to. Just log in online and check your status as often as you like.

VIEW ALL YOUR ACCOUNTS IN ONE PLACE

End your hassle of logging into each individual institution. One and done to see all your funds summarized in one dashboard!

VARIETY OF FUND OPTIONS

You're not stuck with one provider - you've got options. We offer a broad range of funds from multiple providers, not just one.

But good investing isn't necessarily about earning the highest returns, because the highest returns tend to be one-off hits that can't be repeated. It's about earning pretty good returns that you can stick with and which can be repeated for the longest period of time. That's when compounding runs wild. - Morgan Housel, author of Psychology of Money

WHO WE ARE

Family... Plain and simple

The O'Neil Financial Team - Marissa, Mark, Bill and Pat

The O'Neil Financial Team -

Marissa, Mark, Bill and Pat

O’Neil Financial is a full service financial services firm serving clients throughout the Metro Detroit area as well as clients throughout the United States.

Our main focus is building strong, service based relationships. We accomplish this by designing sound, financial plans that are custom tailored to fit your unique and individual needs. Delivering “integrity based” financial planning solutions is our #1 priority.

At O’Neil Financial we are a family owned and operated business, and when you join us you will become family too.

We all live in, work and play in, and actively support the Metro Detroit communities we serve.

We are always nearby when you need us.

Father & Son Team

Imagine the power of having two qualified financial planners working together to design a customized financial plan for you. They always say that two minds are better than one. But what about having two minds for the price of one?

When you work with O’Neil Financial, that is exactly what you get. Bill and Mark work together as a team, along with their support staff. We brainstorm, collaborate, and exchange our thoughts to deliver one great financial plan that is custom tailored to fit your unique situation. We work with you to ensure that your plan is successfully implemented from beginning to end. Also, we encourage you to meet with us frequently, so we can monitor progress and make changes as needed.

WHO WE ARE

Family...plain and simple

At O’Neil Financial we are a family owned and operated business, and when you join us you will become family too.

We all live in, work and play in, and actively support the Metro Detroit communities we serve.

We are always nearby when you need us.

WE ARE FIDUCIARIES

What Exactly Does Ficudiary Mean?

When seeking professional financial advice, it’s crucial to understand the fiduciary tag and its implications. A fiduciary is an advisor who is legally and ethically bound to act in their clients’ best interests. This commitment sets fiduciary advisors apart from other types of financial advisors, such as brokers or sales representatives.

Is there a difference between a fiduciary and someone who takes a fiduciary role?

A fiduciary advisor is an investment professional or financial planner who is legally obligated to put their clients’ interests ahead of their own. This fiduciary duty requires advisors to provide advice that is based on thorough research, objective analysis, and the client’s specific financial situation and goals. Fiduciary advisors are held to a higher standard of care, integrity, and transparency, ensuring the client’s financial well-being remains the top priority.

While someone taking a fiduciary role may choose to work in the best interests of the client, a fiduciary is legal bound to do so.

How do you charge as a Fiduciary?

We are a fee-based advisory firm. This means that we do not receive any sales commissions, quotas, trails or referral fees in connection with our recommendations of securities to clients. We will only recommend the purchase of securities to you when we believe the purchase to be in your best interests. We charge reasonable fees that are calculated based on the value of the assets we manage on your behalf.

Our financial professionals are licensed as insurance agents and may recommend insurance products to clients. In line with our fiduciary duty to you, we will only recommend the purchase of insurance products when we believe them to be in your best interests. We will disclose to you any conflicts of interest related to our recommendation of insurance products so that you can make an informed purchase decision. Clients are never obligated to purchase insurance products through any of our associated financial professionals.

*For further details please refer to the FAN Advisor ADV which is available upon request.”

Unbiased Advice

Fiduciary advisors are legally obligated to act solely in the best interests of their clients, eliminating conflicts of interest and ensuring unbiased recommendations that are tailored to the client's unique needs and goals.

Enhanced Transparency

Fiduciary advisors prioritize transparency and provide clear, comprehensive information regarding fees, risks, and benefits associated with different investment options. They disclose potential conflicts of interest, empowering clients to make well-informed decisions and fostering a relationship of trust.

Holistic Financial Planning

Fiduciary advisors take a comprehensive approach to financial planning, considering various aspects of their clients' financial lives, such as retirement planning, tax strategies, and risk management. This holistic perspective enables them to create customized financial plans that align with the client's short-term and long-term goals, providing a clear roadmap for their financial journey.

WE ARE FIDUCIARIES

What Exactly Does Ficudiary Mean?

When seeking professional financial advice, it’s crucial to understand the fiduciary tag and its implications. A fiduciary is an advisor who is legally and ethically bound to act in their clients’ best interests. This commitment sets fiduciary advisors apart from other types of financial advisors, such as brokers or sales representatives, who may prioritize their own interests or be subject to potential conflicts of interest. This also aligns with our Christian-based values.

Is there a difference between a fiduciary and someone who takes a fiduciary role?

A fiduciary advisor is an investment professional or financial planner who is legally obligated to put their clients’ interests ahead of their own. This fiduciary duty requires advisors to provide advice that is based on thorough research, objective analysis, and the client’s specific financial situation and goals. Fiduciary advisors are held to a higher standard of care, integrity, and transparency, ensuring the client’s financial well-being remains the top priority.

While someone taking a fiduciary role may choose work in the best interests of the client, a fiduciary is legal bound to do so. Therefore, the accountability is guaranteed.

How do you charge as a Fiduciary?

Unbiased Advice

Fiduciary advisors are legally obligated to act solely in the best interests of their clients, eliminating or disclosing conflicts of interest and ensuring unbiased recommendations that are tailored to the client’s unique needs and goals.

Enhanced Transparency

Fiduciary advisors prioritize transparency and provide clear, comprehensive information regarding fees, risks, and benefits associated with different investment options. We disclose potential conflicts of interest, empowering clients to make well-informed decisions and fostering a relationship of trust.

Holistic Financial Planning

Fiduciary advisors take a comprehensive approach to financial planning, considering various aspects of their clients’ financial lives, such as retirement planning, tax strategies, and risk management. This holistic perspective enables us to create customized financial plans that align with the client’s short-term and long-term goals, providing a clear roadmap for their financial journey.

YOUR PARTNERS

MEET OUR EXPERT TEAM

Introducing the experienced professionals behind O’Neil Financial.

Our experts specialize in investment advice, retirement planning, and comprehensive wealth management. Our team’s blend of deep knowledge, diverse experiences, and relentless commitment to client success makes us a trusted partner in managing your financial future.

Explore the dedicated team that will empower you to scale the heights of financial success.

William J. O'Neil

Financial Advisor, CFS®, CRPC®

William J. O’Neil, the founder of O’Neil Financial, is a well known financial planner …

Mark R. O'Neil

Financial Advisor, CFS®, CRPC®, NSSA®

Mark O’Neil is a well known financial planner and financial educator in the Metro Detroit area.

Marissa Bazzi

Client Operations Specialist

Marissa Bazzi joined O’Neil Financial in 2015 and never looked back. Although new to the finance…

Patrick J. Tardiff

Director of Operations

Patrick Tardiff is the newest member of the O’Neil financial team. He joined th…

Schedule a Free, No-Obligation Consultation

Useful Links

Contact

- 7608 Allen Rd. Allen Park, MI 48101

- contact@oneilfinancial.com

- (313) 389-2255

- Secure Upload

- Privacy Policy

- Terms of Use